Suppose you borrow money $1000 from a credit card company that charge you 3% interest rate per month. You will pay $20 per month to pay your debt. My question is simple: when are you going to pay back your debt? In how many months you will be able to accomplish to pay back your loan?

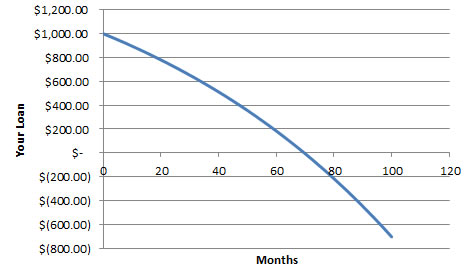

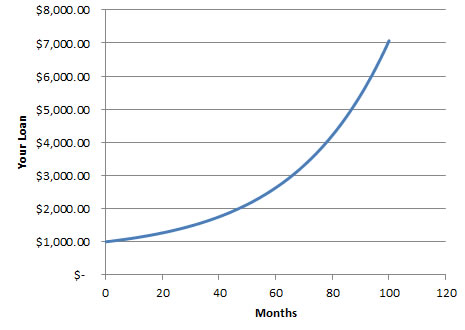

Having the spreadsheet from the previous section is very important tool. I want you to see the chart.

For $1000 loan at 1% interest rate a month and you pay $20, the chart shows you that you need to pay in 70 months (rather than 50 months without interest).

Now do you know how much a credit card company charge you for the interest rate? How much money lender and pawnshop charge you? Usually the charge 3.6% per month up to 10% per month. That is ridiculously very high. In this section, you will see why that interest rate is high and how it can make you bankrupt and in debt forever and ever. AMEN. J

Please guess first before you do the following practice. In how many months you will be able to accomplish to pay back your loan if the interest rate changes from 1% to 3%?

Do not compute until you have a strong guess.

Let us use our spreadsheet (that you have created in the previous section) and change the interest rate from 1% into 3%.

What happens?

Here is the chart of your loan

The curve is going up. It is never reach zero.

When are you going to pay back your debt?

By paying $20 a month, at 3% interest rate you will never be able to pay back your $1000 loan forever!

Surprising, isn't it?

Why is that happen?

Because at 3% interest rate, the interest of your loan grows faster than what you can pay.

That is how the interest rate can make you bankrupt.

Can we reverse the process? How to use interest rate to make you a millionaire? You will learn that in the next section.

Do you like this Tutorial?

Share it with others!

Rate this tutorial or give your comments about this tutorial